Subscriptions

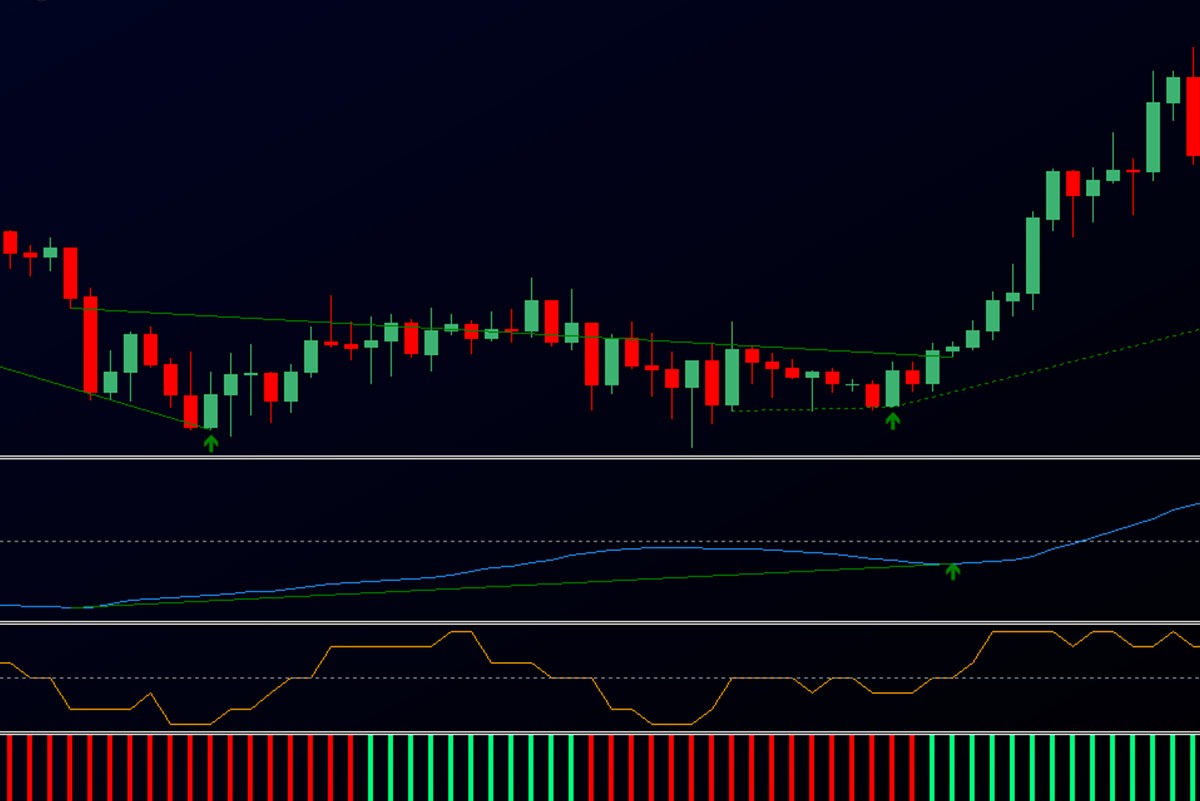

Volume Insight & Divergence

Typical volume indicators provide a useful insight, but lack a significant bias indication and are extremely choppy. Our volume divergence indicator solves this issue by providing a bias for the flow of money over a defined period while smoothing out the cumulative differences to filter out the noise.

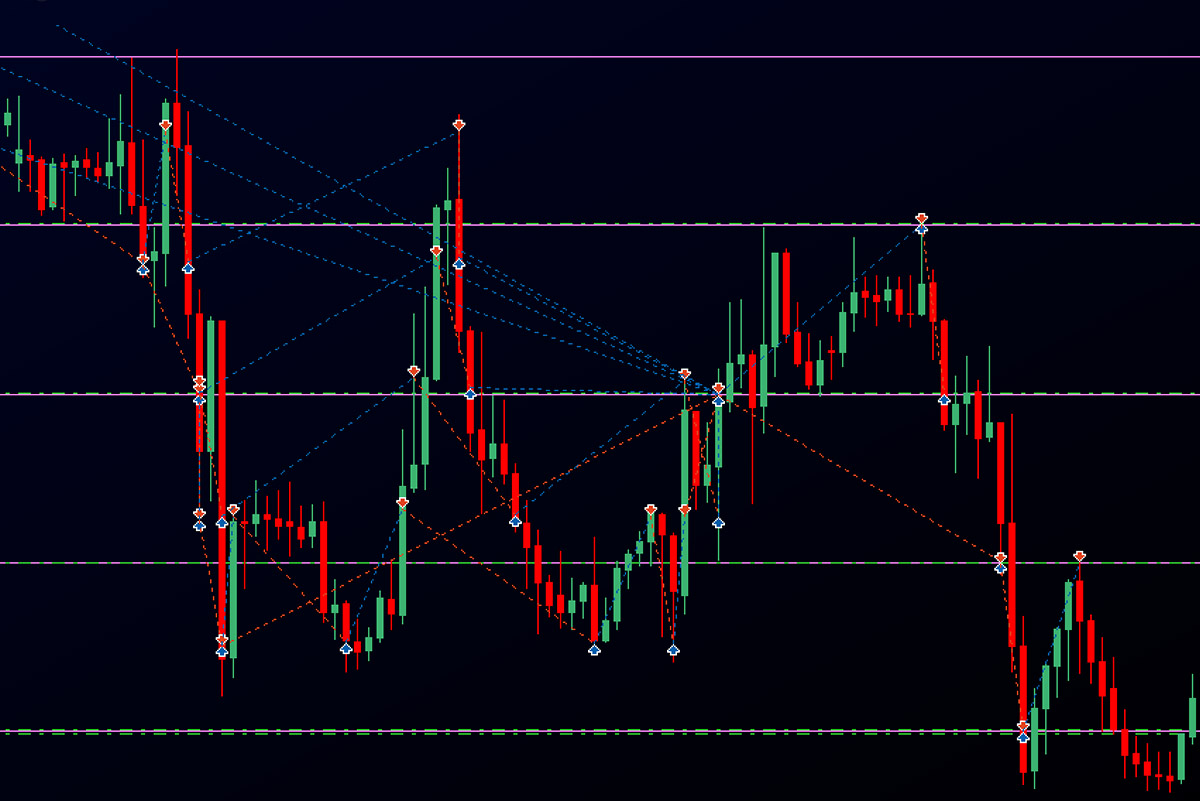

Dynamic Trend Duo

The alphaheim Dynamic Trend Duo is a fully automated trading system designed to trade with the market trend according to two propriety underlying indicators. The system analyses the behaviour of fractals with specified depth parameters to determine elastic pivots and the overall trend bias.

Grid Expert Advisor

The alphaheim Grid EA implements a bi-directional (or dual grid) system, to have both a long and short exposure at every grid level. For this reason, this EA is not FIFO compliant, and would not be suitable for US clients. Our grid system has been designed with account growth and complete stealth in mind.

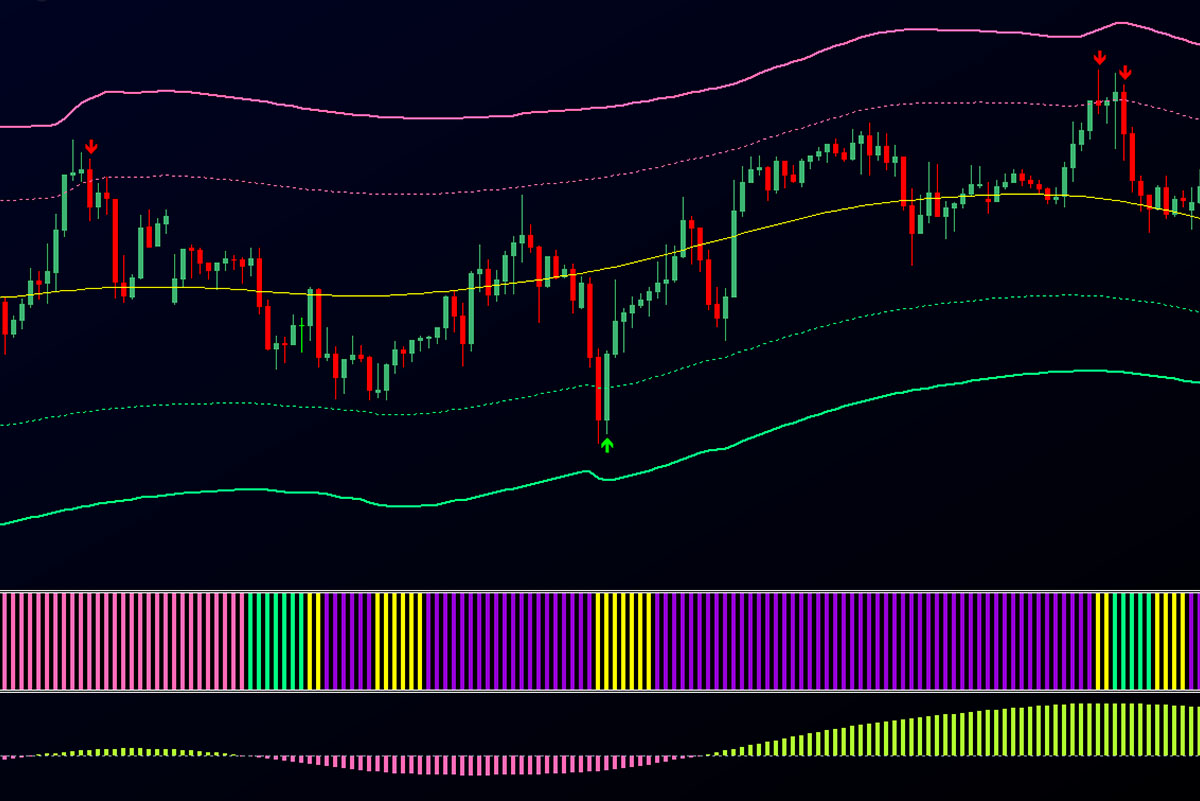

Trend Divergence Indicator

Our trend divergence indicator is based upon an innovative zero-lag, price action cycle phase implementation which assess the significance between a given slope and each data point of the trend cycle period. The algorithm will seek classical and hidden divergences within superimposed cyclical trend component data.

Trend Bias Indicator

We have developed a proprietary points-based scoring mechanism to help identify the current market trend, and possible trend continuations. Our algorithm encompasses several factors key for prediction, whilst also ensuring that the indicator does not lag since this algorithm adjusts to big swings within the market.

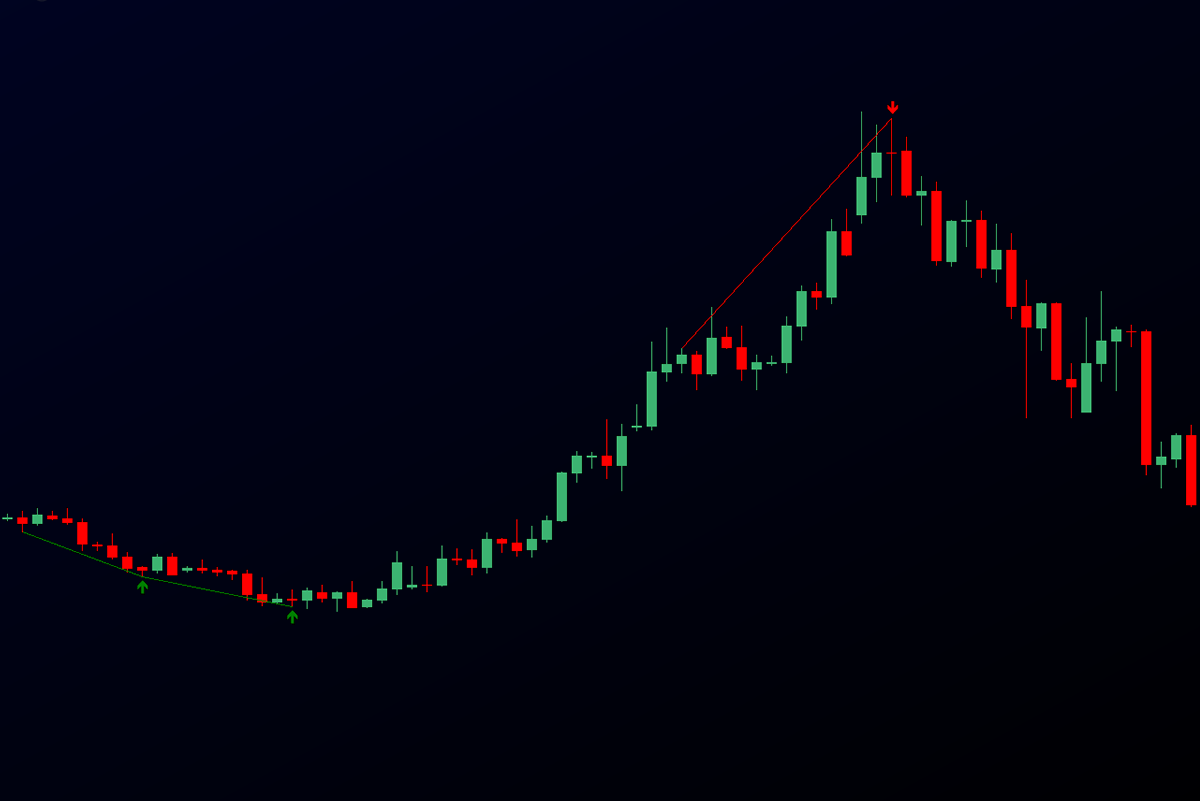

Triangular Moving Average

The Triangular Moving Average (TMA) is a Moving Average that has been averaged again (i.e. averaging the average); this creates an extra smooth Moving Average line. Generally, moving averages are smooth, but the re-averaging makes the Triangular Moving Average even smoother and more wavelike.